-

Personal Banking

-

Business Banking

-

Commercial Banking

- Wealth

-

About Us

Back

-

Personal Checking

-

Personal Savings

-

Personal Online Banking

-

Private Client

-

Webster Investments

-

Borrow

- Plan and Learn

- Personal Banking Resources

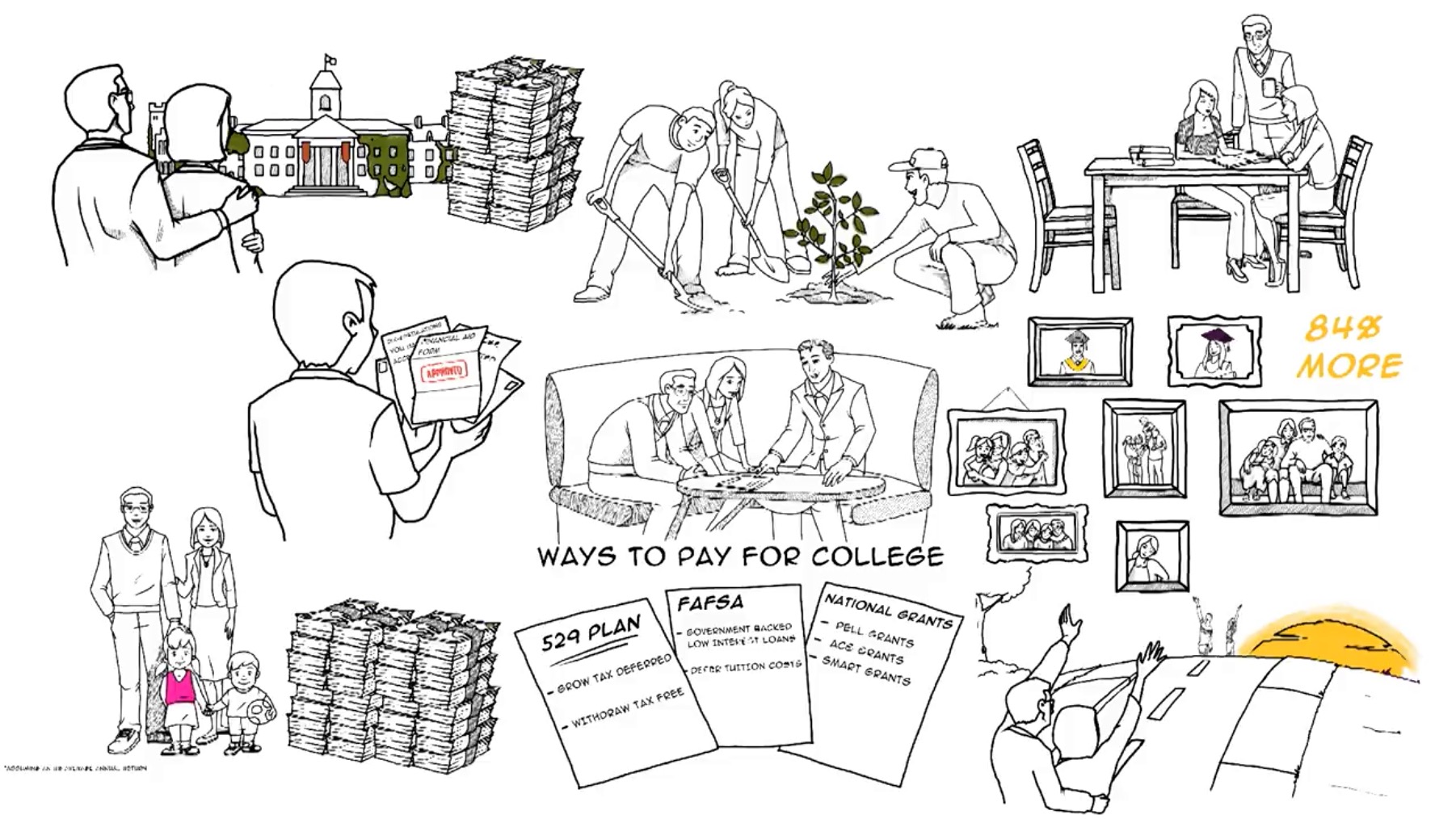

- College Planning Center

Back

-

Business Checking

-

Business Savings

- Private Client

- Business Mobile Banking

- Business Online Banking

-

Business Lending

- Business Credit Cards

-

Payable Solutions

-

Receivable Solutions

- Specialty Services

- Industry

- Plan and Learn

- Resource Center

Back

-

Commercial Lending

-

Specialized Lending

- Community Lending & Investment

-

Treasury Management Services

- Commercial Checking

- Commercial Savings

- Commercial Banking Online Access

-

Commercial Banking Insights

-

Industry Expertise

-

The Private Bank

Back

Back

-

About Us

-

Corporate Responsibility

- Community Lending & Investment

- Banking as a Service (BaaS) – ARCHIVE

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Back

Personal Online Banking

All personal banking clients, please enter your online credentials here:

Need assistance? Contact us.

e‑Treasury Business Banking

Log in

Safeguarding your online banking sessions is our top priority. For information about how you can help protect your online banking sessions, or if you need additional assistance with your e-Treasury log-in, please contact Client Support at [email protected] or 855.274.2800.

Download our e-Treasury Secure Browser

Download our e-Treasury Secure Browser

Business Online Banking

If you need assistance, please contact Client Services at [email protected] or 855.274.2800.

e‑Treasury

Log in

Safeguarding your online banking sessions is our top priority. For information about how you can help protect your online banking sessions, or if you need additional assistance with your e-Treasury log-in, please contact TM Service at [email protected] or 212.575.8020.

Download our e-Treasury Secure Browser

Download the Sterling e-Treasury Token Client

Business Online Banking

If you need assistance, please contact Client Services at [email protected] or 855.274.2800